Loanspot Africa is a digital lending platform that provides loans to individuals and businesses in Nigeria. The company was founded in 2021 by Loanspot, and it is headquartered in Lagos, Nigeria.

Loanspot Africa offers a variety of loan products, including personal loans, business loans, and payroll loans. The company’s loans are available to individuals and businesses with good and bad credit.

Loanspot Africa also offers a variety of repayment options, including monthly installments, weekly installments, and daily installments.

Who owns Loanspot Africa?

LoanSpot Africa is owned by Loanspot, a prominent platform dedicated to providing valuable insights and information about the credit and loans industry. As a trusted source of knowledge, Loanspot consistently educates and guides individuals on various aspects of obtaining loans in Nigeria.

By offering reliable and up-to-date content, Loanspot empowers the public to make informed decisions when it comes to borrowing and accessing credit.

With a strong focus on education, Loanspot equips individuals with the necessary understanding and tools to navigate the complexities of the loan market.

Whether it’s exploring different types of loans, understanding the loan application process, or discovering strategies for securing the best loan deals, Loanspot ensures that its audience is well-informed and equipped to make sound financial choices.

By leveraging the expertise and insights provided by Loanspot, individuals can confidently approach loan applications, effectively manage their credit, and ultimately improve their financial well-being. Loanspot’s commitment to providing reliable information and guidance has made it a trusted resource for those seeking clarity and guidance in the world of loans and credit.

When it comes to making important financial decisions, Loanspot serves as a valuable ally, empowering individuals to make informed choices and optimize their loan experiences in Nigeria.

Is Loanspot Africa Legit?

Yes, Loanspot Africa is a reliable and trustworthy lender. The company has a good reputation and it is regulated by the Central Bank of Nigeria. If you are looking for a loan in Nigeria, Loanspot Africa is a good option to consider.

Features of Loanspot Africa

Here are some of the features of Loanspot Africa:

- Easy and quick application process

- Variety of loan products available

- Competitive interest rates

- Flexible repayment options

- Reliable and trustworthy lender

Pros and Cons of Loanspot Africa

Here are some of the pros and cons of Loanspot Africa:

Pros:

- Easy and quick application process

- Variety of loan products available

- Competitive interest rates

- Flexible repayment options

- Reliable and trustworthy lender

Cons:

- Interest rates can be high for some borrowers

- Not all borrowers are eligible for a loan

- There may be hidden fees associated with the loan

How To Apply for Loanspot Loan

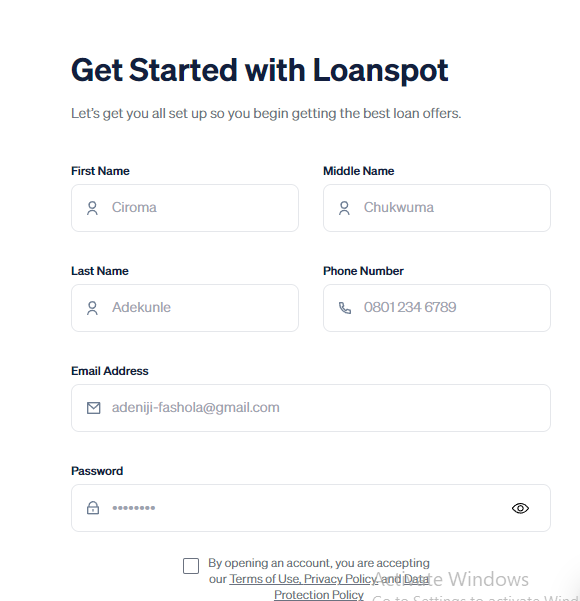

To apply for a loan from Loanspot Africa, you can visit the company’s website or download the Loanspot Africa app. You will need to provide some basic information, such as your name, email address, phone number, and bank account information. You will also need to provide some information about your income and expenses.

Loanspot Africa will review your application and make a decision within a few minutes. If your application is approved, you will receive the funds in your bank account within 24 hours.

Conclusion

Loanspot Africa is a reputable financial institution that provides a diverse range of loan products tailored to meet the needs of both individuals and businesses. Their offerings encompass personal loans, business loans, and payroll loans, ensuring that customers have access to the necessary funds for various purposes.

One of the notable advantages of Loanspot Africa is their inclusive approach to lending. They understand that credit histories can vary, and therefore, they extend their loan services to individuals and businesses regardless of their credit rating.

Whether you have good credit or bad credit, Loanspot Africa strives to assist you in obtaining the financial support you require.

To cater to the unique circumstances of their customers, Loanspot Africa also offers a flexible array of repayment options. You can choose from monthly installments, weekly installments, or even daily installments, enabling you to select a repayment schedule that aligns with your financial capabilities and preferences.

By providing a wide range of loan options and accommodating repayment plans, Loanspot Africa aims to enhance accessibility and convenience for their customers.

However, it’s always advisable to reach out to Loanspot Africa directly or visit their website to obtain the most up-to-date and detailed information about their loan products, eligibility criteria, and terms and conditions.